INFLATION OUT OF THE PICTURE

Posted on November 12, 2014Four Reasons to Expect Lower Prices and what to Do about it

For the past few decades investors had grown used to persistent inflation, it thus made sense to forgo some income in exchange for the security afforded by inflation indexed assets, and to demand returns high enough cover for the expense of rising prices and still get value for money out of their non-indexed investments. Those days are now over, so instead of worrying about prices eroding your earnings, you should now look the other way following four all-important trends that will be pulling prices down for years to come…

A slow-paced Global Economy

The developed world is on its way to recovery after years of wrenching recession and austerity, but it still has a long way to go and it is not getting there fast enough. At the current pace of recovery, with stubbornly high unemployment rates, lacklustre growth in consumption and limited corporate investment there is little pressure on inflation. At the same time, China is now growing at more modest rates compared to the previous decade, and as the dragon goes from a run to a jog, so does its hunger for commodities, further dampening inflation expectations.

Cheaper oil means cheaper everything

To the great surprise of market watchers everywhere, oil prices have been on a free fall since June this year, from $115 at its peak to $83 as October draws to a close. Over supply from OPEC countries in need of cash after years of instability, America’s fracking bonanza, and new opportunities elsewhere are mostly to blame. In contrast, low demand stemming from a slowly recovering global economy can’t just keep up with the oil flood, and since both trends will continue growing apart in the foreseeable future, so will oil keep getting cheaper, knocking down prices in numerous industries and thus slashing costs everywhere.

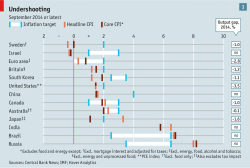

Central Banks have lost the reins

As limited growth and cheaper oil force down prices across the world, Central Banks in developed countries find themselves unable to push inflation back to their official targets, having already driven their official interest rates close to zero. After giving up Quantitative Easing, the only remaining tool to re-ignite inflation with cheap money, America’s FED has lost the reins on inflation, while the ECB has failed to react fast enough and even China’s People’s Bank remains silent at having missed its target of 4% by half the rate. Now that the watchmen have left the field, there is nothing to prevent prices from tripping into a downward spiral.

A self-fulfilling prophecy

Such is the magic of the markets is that if enough people expect something to happen, it will happen one way or another, and everyone is expecting inflation to keep falling. Whether it is worries about Europe, a slowing China or the current oil bonanza, the markets are awakening to the realities of a world of falling prices. As expectations are built up into bonds and futures, firms hold down investments and consumers delay purchases, it will all make deflation a reality out of flagging demand. Barring an unexpected hike in oil prices, markets will keep looking down the whirlpool of deflation, and in doing so, forcing prices to ever lower levels.

How should we handle low inflation in our portfolio?

Now that inflation is low, and likely to stay that way for a while, here are 5 things that you can do

- Get comfortable with lower returns. For example, a nominal return of 4-6% yield for buying a corporate bond and holding to term is not too bad now that inflation is bouncing around 1%. You are still going forward in real terms.

- You should avoid Inflation Indexed assets. You will pay more for inflation hedged bonds for little reason.

- Avoid Commodities: flagging demand and plentiful supply will likely keep their price levels depressed for a few years.

- Consider Real Estate Trusts. With low interest rates likely for a while, real estate trusts will benefit both from lower debt costs and from the increasing attractiveness of their yields.

Keep an eye on the Medium Term. Low inflation is here to stay for at least the next few years, but chances are high that it will eventually return to the average in the long run. The thing to watch is capacity utilisation numbers which indicate that pricing pressure is around the corner.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: 2014, Caterer Goodman, central banks, China, Emerging Market, Finance, Financial Advice, Global Economy, inflation, Investment, Market, Money, Owen Caterer

Categorised in: Economic Commentary