Why Gold Doesn’t Matter

Posted on April 18, 2013 Gold doesn’t matter, but another falling commodity does…

Gold doesn’t matter, but another falling commodity does…

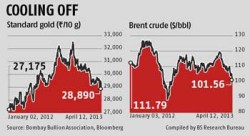

The stunning plunge in the gold price recently has created headlines. On Monday alone it fell 9%, in the biggest fall since 1980. Given we aren’t a gold bug for a large variety of reasons; it has meant little to us. In fact we think far more interesting things are going on in other commodities, particularly the oil price, which we think is good news for the world economy.

Why Gold doesn’t matter

Why Gold doesn’t matter

This might surprise you, but most gold is speculation or used as a “store of value”. We think that if you wanted a truly then other things like agricultural land, have a more sustainable value in the unlikely event of the collapse of the world’s financial system. You can’t eat gold. You can’t live in it. You can’t wear it. It is more correlated with equity markets than you think (down 30% during the financial crisis). Its only remaining practical function is decoration, and even that is arguable that it is really “practical”. Though don’t get into an argument with a gold bug, they tend to be passionate types (to put it politely).

Falling gold prices mean that more people are getting confident again. The recovery, which is under way, but not really yet building a head of steam, needs a strong boost of further confidence. Large sales of gold by the Chicken Littles of the world mean that the big thing missing, investor confidence is starting to return. Still, the falling gold price has distracted us from a more important news story.

Oil matters in the real world

Oil on the other hand is important. This isn’t a value judgement, we wish there were an easily transportable, useable, storable and widely available commodity that could generate that level of energy quickly and easily. But there isn’t. That is the true value of oil. Because oil is used in transport just about everywhere, its price is, in some small way, built into the cost of just about anything you can get in a shop. With all major contracts for Oil at lows over a 3 or 6 month period and trending to continue, thing are looking up for two reasons.

- People: Lower inflation or put another way – better bang for your buck.

- Companies: Better profit margins or cheaper prices.

Oil supply is increasing – it isn’t falling demand

Now Economic growth isn’t wonderful, but neither is a lower oil price a sign of stalling world demand. If anything a lower oil price is one of the economy’s best news stories in years. The reason is an increase in supply. You might have heard that America is on track to be the largest oil producer in the world by 2020 (that’s just seven years away now). Not only that, but American natural gas supplies are booming and they have the lowest costs in the world. They would quickly become a major exporter if the US government had actually given out more than one export license. As the economist describes the situation.

Now Economic growth isn’t wonderful, but neither is a lower oil price a sign of stalling world demand. If anything a lower oil price is one of the economy’s best news stories in years. The reason is an increase in supply. You might have heard that America is on track to be the largest oil producer in the world by 2020 (that’s just seven years away now). Not only that, but American natural gas supplies are booming and they have the lowest costs in the world. They would quickly become a major exporter if the US government had actually given out more than one export license. As the economist describes the situation.

No LNG facility besides Sabine has yet received permission to export. American law requires the Department of Energy to determine whether gas exports are in the public interest, and President Barack Obama’s administration is in no hurry to make up its mind.

So what does this mean?

A few things such as:

- Lower energy prices are unambiguously good for the economy, but the effects will take a while to be felt.

- Big operators of fleets are starting to convert their vehicles to natural gas like FedEx. This means that conversion companies, and fleet operators should both benefit.

- If you take a long view (possibly really long since the US federal government is involved) then natural gas prices are likely to increase at some point in the future with increased exports. So US gas producers could be worth a look.

- There is reason to be cautious for Asian gas producers, since they are currently achieving the highest prices per BTU (a market measure of gas) and may be undercut by American and Canadian supplies in the future.

The Inside View

We have been discussing the implications of the above, particularly energy prices, with our clients for quite some time. If you want your money to be managed by a full-time professional advisor or are simply curious to learn more about what options are out there for expatriates, drop us a line.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, Expat, Fell, Gold, Investment, Money, Oil, Owen, Owen Caterer, Price Down, Shanghai

Categorised in: Commodity, Economic Commentary, Investments, Market Flash, Offshore