The US property market rebounds

Posted on November 9, 2012 Although many people are still arguing about the “real cause” of the financial crisis, usually to suit their own conspiracy theory, the humble truth remains that it was an old fashioned property boom and bust that was true cause and starting point. We have believed, since early last year, that a recovery in the US housing market is imminent, and we are starting to be proven correct.Let’s however put this in contextThe Housing Construction Boom & Bust

Although many people are still arguing about the “real cause” of the financial crisis, usually to suit their own conspiracy theory, the humble truth remains that it was an old fashioned property boom and bust that was true cause and starting point. We have believed, since early last year, that a recovery in the US housing market is imminent, and we are starting to be proven correct.Let’s however put this in contextThe Housing Construction Boom & Bust

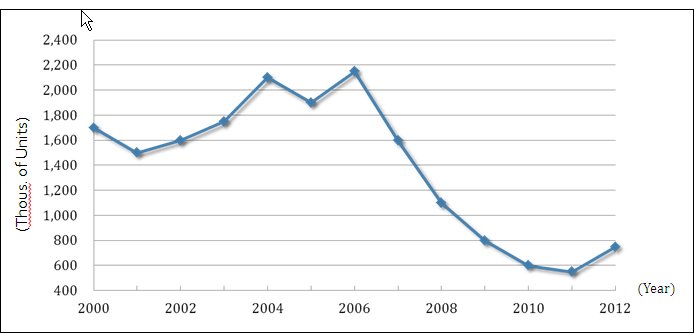

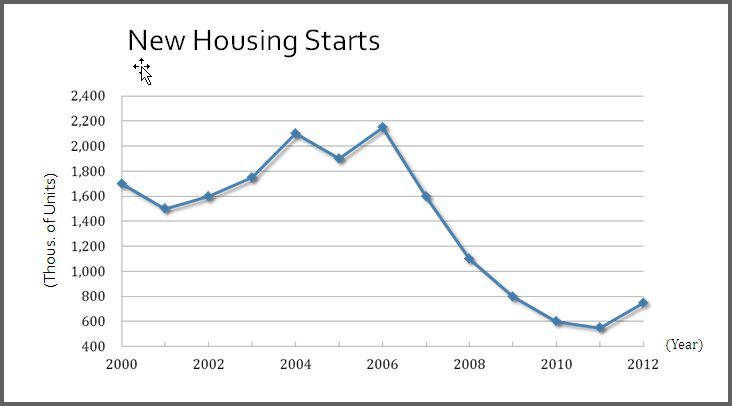

Prior to the financial crisis housing construction, which normally tracks at around 1.2 million dwellings per year, suddenly zoomed to almost 2 million per year. An amount far beyond demand. The crash however pushed construction down to a mere 400,000 dwellings per year, far below demand. But what is demand?

The Demographic Foundations of Demand

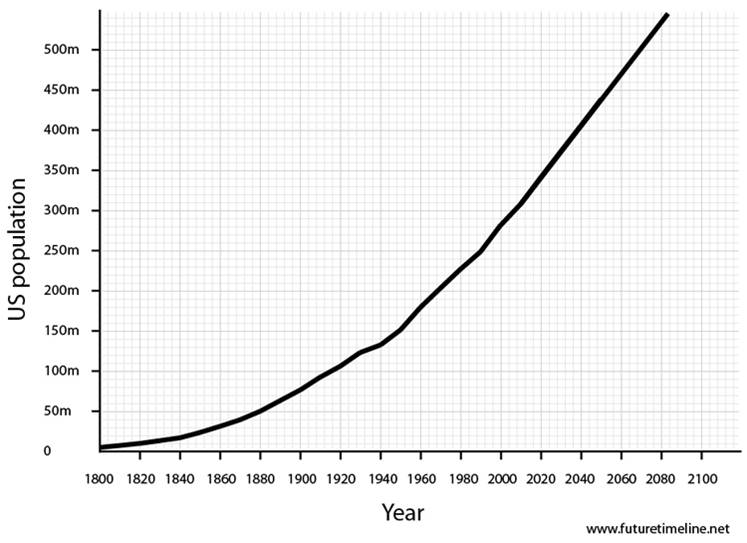

The United States grows its already sizeable population at about 3 million people per year, give or take. This equates to housing demand of about 1-1.2 million dwellings per year (with household size about 2.3 people on average), depending on your preferred housing formation statistic. This helps explain why supply was too much, and now more recently, not enough for underlying demand more recently. It is why the recovery has commenced.

The Recent Recovery

Many different news reports in recent months have reported that the US housing market is indeed starting to rebound. This is based on many different trends including the leading index, the Case Shiller index.

Sales of existing houses has fallen. That would often mean a decline in confidence, but many such as this Bloomberg article.

The rise in property prices has many impacts. The main is on existing and older mortgages as this quote points out.

“More than 1.3 million homeowners who were “underwater” on their mortgages — the owners owe more than their property is worth — have moved above the break-even point on their homes, according to CoreLogic of Santa Ana, California.”

Still, the improving housing market hasn’t yet helped the wider economy catch on fire as this article points out. Still, as less mortgages are underwater, more renovations happen and new construction picks up, it certainly can’t hurt.

How to invest

It is possible to buy a property in the US as a foreigner, but keep in mind that as a non-resident alien a mortgage is almost impossible for most purchases. Also the US has higher property prices than most places, and renting your property will require your involvement in finding and helping manage your agent, so it’s not the low involvement way to invest.

You could invest in a US homebuilders Index fund, but we must point out these funds have already had strong rises of more than 100% from their lows, and are no longer cheap. We do work with some distressed property funds, which are a very good hands-off solution as well as property syndicates which can start as low as $10,000 USD minimum investment. Contact us for more information.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, Investment, Market, Owen, Owen Caterer, Property, Rebound, Shanghai, US, US property market

Categorised in: Emerging Markets, Investments, Property