The best financial news sites are…

Posted on June 6, 2014Finding a good investment is a wheat/chaff sort of problem. Interestingly enough the financial media these days seems to be a similar sort of problem. The cause has many potential sources. Falling advertising causing falling editorial budgets is one. The need for a constant supply of content online is another. The increasing wave of “click bait” headlines that screams things like “Markets due for a fall.” or “A massive correction is on the way. Learn why” or even things like “Why Marc Andreesson’s very nervous, anxious and upset”. Apparently it is related to global cyber ways, but in an article that goes for around 150 words in total, it isn’t very clear.

So how to find useful information in a deluge of data chaff? Your time is limited and reading hundreds of articles each day is rarely going to add much value. So what are your thoughts on different news platforms?

What are we looking for?

When investing you need good information, not “articles” based on rumors and self-promotion but interesting information based on cold hard facts. On many TV channels and websites the editors make the mistake of confusing opinion and quotes with news. Real analysis should be based on data and quotes from interested industry players being discounted or ignored. Also, when managing your portfolio you may want to learn more about particular sectors, stocks or funds and we will go through a few of the options here. We try to tease out the useful from the interestingly titled click-bait since some editors

CNBC

When we are posting links to articles in China for our LinkedIn presence we tend to look for things that don’t require a VPN to access (sorry Bloomberg! sorry NYT!) and look for the more interesting titles. CNBC is where we turn for these types of tit-bits since they specialize, if anything, on getting the title to be attractive. But by golly, does it take a while to find an article that adds something of value from CNBC’s site. Oh yes. CNBC, having a TV show to help produce content has a weakness for inflammatory quotes from talking heads. The vast bulk of these articles are in many cases only marginally better than click-bait and junk. We suspect that some of the articles start life as a sound bite on one of these TV shows with some context thrown in to provide some bulk.

When we are posting links to articles in China for our LinkedIn presence we tend to look for things that don’t require a VPN to access (sorry Bloomberg! sorry NYT!) and look for the more interesting titles. CNBC is where we turn for these types of tit-bits since they specialize, if anything, on getting the title to be attractive. But by golly, does it take a while to find an article that adds something of value from CNBC’s site. Oh yes. CNBC, having a TV show to help produce content has a weakness for inflammatory quotes from talking heads. The vast bulk of these articles are in many cases only marginally better than click-bait and junk. We suspect that some of the articles start life as a sound bite on one of these TV shows with some context thrown in to provide some bulk.

Forbes/Time/Fortune

All are OK and you’ll pick up the odd bit of good information, but for the most part these platforms to me seem to be followers and not leaders. The lists are interesting, but rarely are they very valuable and even the features usually struggle to get past the surface gloss and to the real story. They often pull their punches and when they do reach a position, it’s one that was probably reached in the financial media weeks or sometimes months ago. I’m struggling to think of a real story that these magazines have broken or an unusual angle to consider that they have raised. The only exception is the occasional story or interview that Fortune includes on managing your portfolio for an American audience. Some of these are useful, we will admit. The writing is solid and the point made is true enough, but the usual process is to repackage information or stories from that have broken elsewhere in a readable and engaging way. Good enough to start, particularly if you aren’t that technical and not yet investing, but easy enough to ignore if you are serious about investing and already have some knowledge.

All are OK and you’ll pick up the odd bit of good information, but for the most part these platforms to me seem to be followers and not leaders. The lists are interesting, but rarely are they very valuable and even the features usually struggle to get past the surface gloss and to the real story. They often pull their punches and when they do reach a position, it’s one that was probably reached in the financial media weeks or sometimes months ago. I’m struggling to think of a real story that these magazines have broken or an unusual angle to consider that they have raised. The only exception is the occasional story or interview that Fortune includes on managing your portfolio for an American audience. Some of these are useful, we will admit. The writing is solid and the point made is true enough, but the usual process is to repackage information or stories from that have broken elsewhere in a readable and engaging way. Good enough to start, particularly if you aren’t that technical and not yet investing, but easy enough to ignore if you are serious about investing and already have some knowledge.

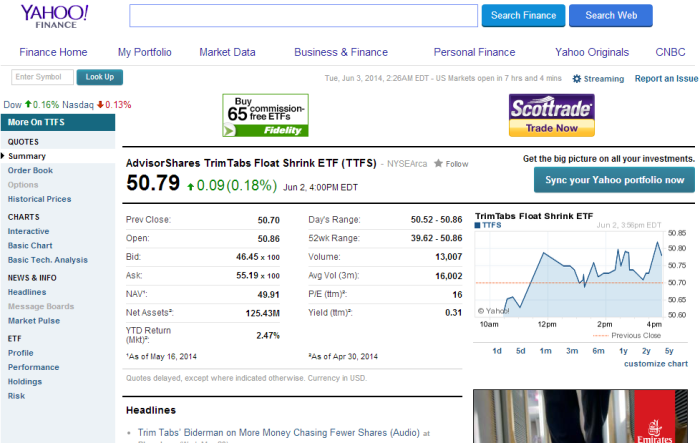

Yahoo Finance

Yahoo finance is something of an aggregator providing links to articles from everywhere and due this is something of a hit and miss type of things. Yahoo does have good graphing functions and you can look at individual holdings, and also the option interest through their platform. And for that, they make the cut as one of the platforms worth a look. Not for the news, but keeping track of your stocks without logging into your actual trading account.

Yahoo finance is something of an aggregator providing links to articles from everywhere and due this is something of a hit and miss type of things. Yahoo does have good graphing functions and you can look at individual holdings, and also the option interest through their platform. And for that, they make the cut as one of the platforms worth a look. Not for the news, but keeping track of your stocks without logging into your actual trading account.

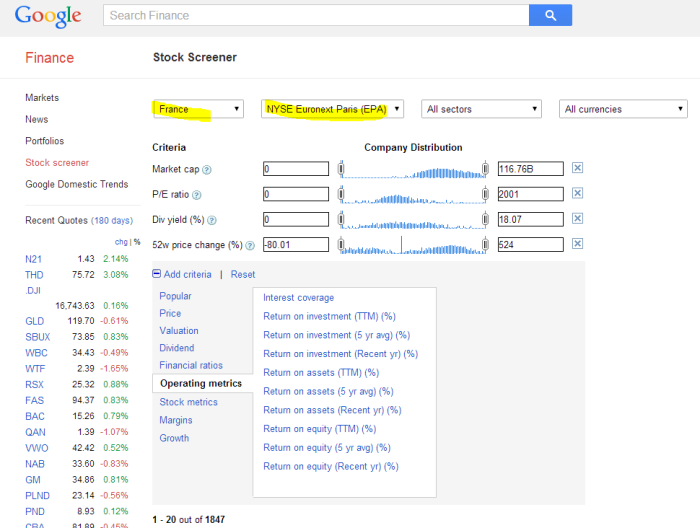

Google Finance

Again like Yahoo it doesn’t produce its own content. In fact, it isn’t really even an aggregator. But it does have interesting graphing ability and its stock screener is one of our recommended methods for the average investor, particularly now they provide a breakdown into 37 different stock markets around the world. They are a bit ambitious though since some markets like China, aren’t available to foreigners. Still, it is good to have a bit of ambition. Not yet the killer application that Google could make, but it is certainly useful. Google is a bit unstable without a VPN in China, but that shouldn’t bother any long term expatriate who has had a solution for years. Now if they could only get a button that could exclude listed trusts and funds and focus just on individual shares (or vice versa), that would be just wonderful. Google? Are you listening?

Again like Yahoo it doesn’t produce its own content. In fact, it isn’t really even an aggregator. But it does have interesting graphing ability and its stock screener is one of our recommended methods for the average investor, particularly now they provide a breakdown into 37 different stock markets around the world. They are a bit ambitious though since some markets like China, aren’t available to foreigners. Still, it is good to have a bit of ambition. Not yet the killer application that Google could make, but it is certainly useful. Google is a bit unstable without a VPN in China, but that shouldn’t bother any long term expatriate who has had a solution for years. Now if they could only get a button that could exclude listed trusts and funds and focus just on individual shares (or vice versa), that would be just wonderful. Google? Are you listening?

Bloomberg Website

The Bloomberg website is one of the better platforms around for reading and considering what portfolio holdings you have. It is does tend to lean towards the larger and more macro view rather than the daily inane chatter on say CNBC, although it can be mixed from time to time. It discusses many parts of financial markets and you’ll find discussions on commodities and bond yields that you won’t find many places else. Some of the articles on say individual commodity prices are some of the best you’ll find without a subscription to a specialist data or information service. They combine considerable quantitative data with interviews from people in the industry, rather than just some random portfolio manager out to build the profile. You can also use Bloomberg to have a look at your recent stock performance, although personally we prefer either Yahoo or Google.

The Bloomberg website is one of the better platforms around for reading and considering what portfolio holdings you have. It is does tend to lean towards the larger and more macro view rather than the daily inane chatter on say CNBC, although it can be mixed from time to time. It discusses many parts of financial markets and you’ll find discussions on commodities and bond yields that you won’t find many places else. Some of the articles on say individual commodity prices are some of the best you’ll find without a subscription to a specialist data or information service. They combine considerable quantitative data with interviews from people in the industry, rather than just some random portfolio manager out to build the profile. You can also use Bloomberg to have a look at your recent stock performance, although personally we prefer either Yahoo or Google.

*We are only talking about the website and not the TV or the terminal. The terminal is for professionals and worth it, although we have reservations here too and the TV channel is one of the better TV based sources around. That doesn’t say much since TV isn’t really our preferred information source. It is more for entertainment.

Financial Times, New York Times and Wall Street Journal

We have found their reporting to be good to excellent, there is enough of a pay-wall here that we have chosen to exclude them from our review article today.

Seeking Alpha

A website you may never have heard of if you aren’t investing in shares, Seeking Alpha is sometimes surprisingly good and often very average. Essentially, if you aren’t familiar, Seeking Alpha is an open website that allows people to develop a profile by analysing stocks or investment ideas and posting articles. Some posters have developed a strong following with hundreds of posts, which I guess is the goal for most. Since posters run the gamut, so does the quality. We occasionally drop by for a virtual wander for three reasons. Firstly, when we are looking for new ideas, we might have a look through a dozen articles or so. Sometimes it can take 30 before one has enough of an insight to justify further research, but it does help to get you out of any box you might find yourself in. Secondly, some posters can provide very useful summary lists on exchange traded funds for particular areas (say finance or Europe), which can give you a starting point for choosing the best access method. There is also the occasional strong piece of research, but these aren’t necessarily with the most experienced or most followed posters. Thirdly, when investing, it is useful to consider the counter-factual. Rather than just finding supporting evidence, it is useful to consider what opposing counsel has to say to and consider its validity. With so many voices, Seeking Alpha is often good for finding someone to find the flaws in your investment idea.

A website you may never have heard of if you aren’t investing in shares, Seeking Alpha is sometimes surprisingly good and often very average. Essentially, if you aren’t familiar, Seeking Alpha is an open website that allows people to develop a profile by analysing stocks or investment ideas and posting articles. Some posters have developed a strong following with hundreds of posts, which I guess is the goal for most. Since posters run the gamut, so does the quality. We occasionally drop by for a virtual wander for three reasons. Firstly, when we are looking for new ideas, we might have a look through a dozen articles or so. Sometimes it can take 30 before one has enough of an insight to justify further research, but it does help to get you out of any box you might find yourself in. Secondly, some posters can provide very useful summary lists on exchange traded funds for particular areas (say finance or Europe), which can give you a starting point for choosing the best access method. There is also the occasional strong piece of research, but these aren’t necessarily with the most experienced or most followed posters. Thirdly, when investing, it is useful to consider the counter-factual. Rather than just finding supporting evidence, it is useful to consider what opposing counsel has to say to and consider its validity. With so many voices, Seeking Alpha is often good for finding someone to find the flaws in your investment idea.

The Economist

We like the Economist for several reasons. Yes, it can verge on the dry side, but still the writing style is direct and clear and not prone to hyperbole. Secondly there is a reverence for data and a suspicion of quotes. Many journalists are trained to look for sources, but when every potential player has an angle to run or cheerlead, quite often the result is just noise and confusion, not clarity. Thirdly, the writer of every article always seems knowledgeable in their area. They don’t shy away of poking the obvious holes in the arguments of those they quote. Many journalists don’t have the required knowledge or understanding of their field, but it is obvious when the journalist does. Fourth, they aren’t afraid to say or imply where their opinion stands, although they will only do so when examining the counter arguments.

We like the Economist for several reasons. Yes, it can verge on the dry side, but still the writing style is direct and clear and not prone to hyperbole. Secondly there is a reverence for data and a suspicion of quotes. Many journalists are trained to look for sources, but when every potential player has an angle to run or cheerlead, quite often the result is just noise and confusion, not clarity. Thirdly, the writer of every article always seems knowledgeable in their area. They don’t shy away of poking the obvious holes in the arguments of those they quote. Many journalists don’t have the required knowledge or understanding of their field, but it is obvious when the journalist does. Fourth, they aren’t afraid to say or imply where their opinion stands, although they will only do so when examining the counter arguments.

You can read the general edition, although a couple of the online blogs are worthy of more in-depth attention. These can be more technical and more for the investing professional, but we think it is better to err on the side of dry rather than fluffy. It is hard to pick favorites but when it comes to investing pay attention to Buttonwood’s Notebook and Free Exchange.

The weakness of the Economist is three-fold. It isn’t a news wire so some of the articles aren’t particularly timely. If you want news or views on what is happening today, then the Economist isn’t for you. The last few days or week is the Economist’s schedule. Secondly, the Economist isn’t panoramic on financial markets. It doesn’t have an opinion or news today on the price of oil and you aren’t likely to find an article on this. Lastly, you aren’t going to be able to do product or stock orientated investment analysis through this site or platform. The economist is designed for the big picture and not for this type of analysis.

In Summary

If we had to pick just one platform, we’d say, read the Economist and use Google or Yahoo finance to track your share and fund prices. For commodities or up-to-date analysis we find Bloomberg consistently the best. Try not to get involved in the nitty-gritty of market jumps since the vast majority is just noise and following them isn’t a good use of your time. The most perspective you get, the better for you and your portfolio we believe.

Summary of Tips

- So look for data

- Be suspicious of quotes.

- Consider both sides

- Extreme views are rarely right.

- Conspiracy theories are usually too complicated to be right.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Advice, Americans, Caterer Goodman, China, China Expat Money, Expat, Expats, Financial Advisor, Financial news, Foreigners, Investment, Owen Caterer, Shanghai

Categorised in: Financial Advice