Dow hits record – Your investments keeping up?

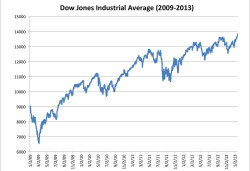

Posted on March 8, 2013 The Dow Jones Industrial Average, the index composed of the 30 largest and most established companies in the US, made a new record high this week, more than double where is was in early 2009. The question is, how has your investment performed during that same time period? If your investments are still on the launching pad it may be time to find out why.

The Dow Jones Industrial Average, the index composed of the 30 largest and most established companies in the US, made a new record high this week, more than double where is was in early 2009. The question is, how has your investment performed during that same time period? If your investments are still on the launching pad it may be time to find out why.

It usually comes down to two reasons. Either the cost to invest or the assets (funds/stocks) you have bought.

You would think even the most average of investors or advisors should have been able to capture at least 50% of this rise. It shouldn’t have mattered what you picked. Almost all asset classes have done exceptionally well since the spring of 2009 whether that was

- Stocks (Dow 100%+),

- Bonds (TLT 28%+),

- Real estate REITS (IFNA 180%+), or;

- Precious metals (Gold 70%).

So if your account is still flat lining, it can only come down to one thing. It HAS to be the costs you are paying to invest.

First thing to look at are how many parties are involved in the make up of your investment i.e. advisor, fund platform wrapper, fund management company. It would be logical to think that each one of these entities needs to pay their bills and make a profit and the only way to do this is to take a cut of what you have invested each and every year. So it would seem rational, if we want to cut your investment costs, the best thing to do is to streamline your investment and reduce the number of companies that are feeding off your account.

There are a number of things you can do to reduce your costs.

- If you are dealing with a commission based advisor and on top of their sizeable commissions they are charging you a yearly management fee, cancel the service…you are not making any money, why should they? Surprisingly enough they will still look after you.

- Do you really need your investment tied into a fund platform wrapper? Your advisor will say to you “the wrapper will make it more tax efficient”, but taxes only matter when you actually have profits.

- Lastly, instead of investing in expensive actively managed under performing funds, look for comparable ETFs (exchange traded funds) that operate at a fraction of the costs and actually consistently perform better. Amazing how that works; the lower the fees the better the performance.

If you prefer to ignore the obvious signs of failure, then feel free to continue as you are. However there is a better way and if you want to look at reducing costs for better performance then talk to us. Caterer Goodman Partners are primarily a fee based advisors specializing in low cost managed accounts. To learn more call our Shanghai office on (021) 3366 1337. You don’t need your money breaking records, but a decent positive return would be a good start, right?

Bill Longstreet has been a financial advisor since 2003 and prior to this were a institutional business development director, specializing in fixed income and foreign exchange markets. Bill has a Master in Business Administration with a concentration in Finance (1999) from the Olin School of Business at Washington University in St. Louis and am a candidate for the CFP (Certificate Financial Planner) qualification. He also holds a Bachelor of Arts with a Major in Economics from Denison University. In his last position before joint Caterer Goodman oversaw $350 million in client funds across a range of currencies and risks profiles.

Tags: Caterer Goodman, China Expat, cost to invest, Dow Jones, ETF, Invest Tips, Investment, Money, Offshore investments, Portfolio, Record High, Return, Shanghai Expat, US Expat

Categorised in: Financial Advice, General, Investments