2017 – Investment Ideas

Posted on January 21, 2017US Dollar Strength

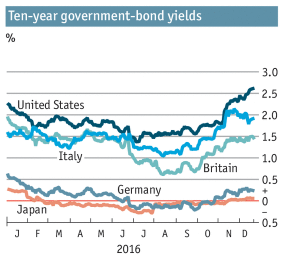

The US Federal Reserve put up interest rates over night and according to their statement, another 3 rate rises could be in the mix for 2017. If only 2 happen then a great big sucking sound of money rushing from negative rates in Europe and Japan, and zero rates in the UK would become deafening. The obvious winner is the US dollar, whose strength will make President Trump’s job in kick-starting manufacturing, just that bit harder. Given that a higher dollar might make corporate profits tough, it might make sense for a simple US cash currency holding.

Short Bonds

The other side of rising rates is that means the price of bonds must fall. If inflation continues to firm and the US Federal Reserve keeps to its schedule then shorting US government bonds is one of the few safe bets around. Look at ETFs that do the work for you, like PST and TMV.

Banks and Financials

The surprising winner so far from President Trump is the banking and finance sector, and policy developments in line with his post-election rhetoric will continue to support this sector. Unlike other sectors, higher rates means profits and the stock prices will surely follow.

Beware Overheated Markets

Given the specter of higher rates the US markets have been on something of a sugar rush high since the election. History however suggest that higher rates crimp profits and therefore the share market, so it pays not to greedily chase the market too hard. Remember, be greedy when others are fearful and fearful when others are greedy. Others are greedy right now, so worth picking your moments to enter the market.

Long Term Winners

Some companies can grow and benefit no matter the macroeconomic environment. Look at the gains that McDonalds delivered Warren Buffett for decades that included the awful 70’s and difficult 80’s. Long term plays should be bought in market corrections and could include Google, Amazon, Microsoft (yes, really) and Starbucks.

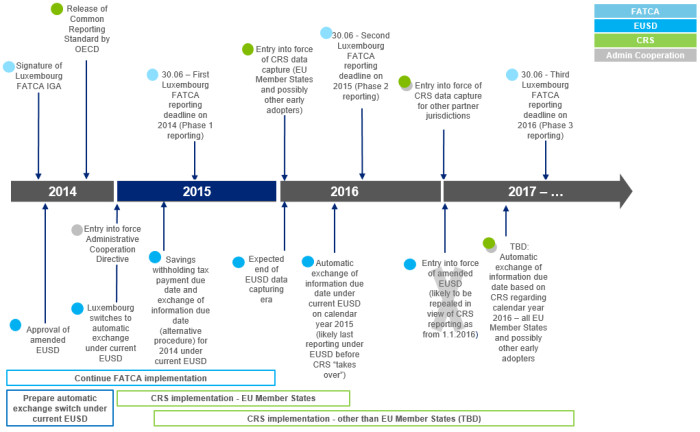

Get your tax affairs sorted

Yes, we do realize this is not technically an investment trend, but certainly something to watch. The “Google of Tax” is coming in 2017. Expect to hear more from us on this in future posts, because trust us, this is possibly the biggest news in the whole newsletter. We hid it here to see who makes it this far. In future tax authorities from practically every major country, including China, will have complete access to their citizens bank holdings globally with merely the click of the mouse. Call it the “Google for Tax Authorities” or the “Facebook of Finance” but whatever it is, it will be a game changer.

If you want to learn more, look up Common Reporting Standards (CRS). It’s essentially the global version of the US FATCA legislation. It would be a good idea to talk to your accountant about how to report your unspoken bank or investment accounts properly. You have nothing to worry about if you have nothing to hide. But best get organized now because even the Chinese authorities will be able to find your offshore bank account next year. Talk to us if you want a referral to a good tax accountant. There are strategies you can still use to minimize your exposure, but you best start soon, because the system goes live in June 2017.

Three Contrary Picks with potential.

- European equities markets have lagged the US markets the last few years due to the obvious problems in the Euro-zone. Valuations are relatively low and the lower Euro is helping. Any unexpected good news, or merely an absence of bad news could see good gains.

Russia: With a friend in the White House and in the State Department the rebound of Russian equities off the floor could well continue. The market is still (next to Iraq) the cheapest in the world and still down heavily from 5 years ago, so it has plenty of room to run. The removal of even some sanctions could see a market run.

Russia: With a friend in the White House and in the State Department the rebound of Russian equities off the floor could well continue. The market is still (next to Iraq) the cheapest in the world and still down heavily from 5 years ago, so it has plenty of room to run. The removal of even some sanctions could see a market run.

- Pharma and Healthcare: The most unpopular sector in the US in 2016 may have all the bad news priced in. Trump focusing his deal marketing acumen attention elsewhere would be enough for the market to remember that demographics is a huge tailwind for the sector.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: +CatererGoodmanParnters, 2017, Advice, Bonds, Caterer Goodman, Caterer Goodman Partners, Caterergoodman, China Expat Money, Comparison, Expat, Investment, Owen, Owen Caterer, Shanghai, Tax Advice, US Dollar, www.caterergoodman.com

Categorised in: +CatererGoodmanPartners, American Investors, Caterer Goodman Partners, Economic Commentary, ETF's, Financial Advice, Investments, Offshore, Tax Advice