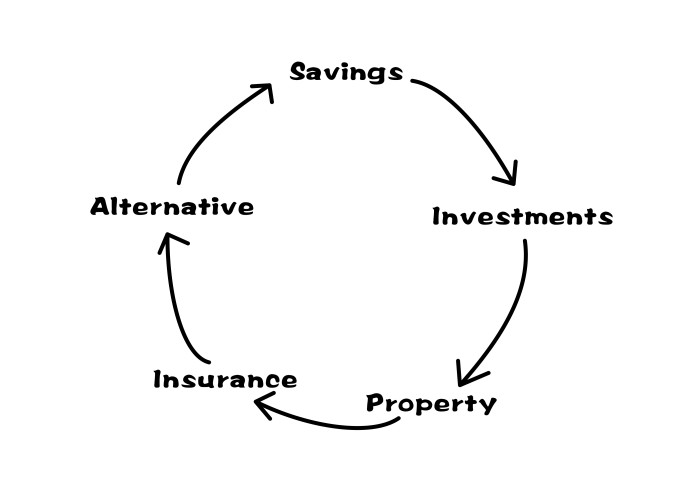

The Investment Cycle

Posted on November 22, 2016 Investing can be as simple or as complex as one wants it to be but the basic structure should remain relatively the same. Whether you are a seasoned equity trader or looking to open your first bank account, you should look at the Investment Cycle to see what areas you might be want to bolster up.

Investing can be as simple or as complex as one wants it to be but the basic structure should remain relatively the same. Whether you are a seasoned equity trader or looking to open your first bank account, you should look at the Investment Cycle to see what areas you might be want to bolster up.

First and foremost are savings in the bank. There’s no faster way to access cash than through a bank account (unless it’s hidden under your mattress) so whether you need to withdrawal cash in case of a medical emergency or for a spur of the moment holiday, holding cash in the bank is crucial for those necessity moments. However we all know that money in the bank doesn’t make your money work any harder for you, so beyond the 4-8 months of salary equivalent in the bank you shouldn’t carry much more of a balance than you need. We say 4-8 months as a general guideline. If you’re young and single perhaps 3 months may be sufficient where as if you’re raising a family of 5 then perhaps 9 months may be more suitable.

Second comes investments. Once you’ve built up a comfortable savings cushion, it’s time to start making your money work harder for you. You should look for a diversified investment that gives you access to stocks, bonds, and mutual funds and whether you manage it on your own or leave it to a financial advisor again the structure should remain rather similar. Funds that trade on stock exchanges called ETF’s (exchange traded funds) should make up a majority of your holdings, but if you’re young or have excess capital then individual stocks might be appealing. Bonds are also part of a balanced portfolio and for those looking for protection or perhaps some security before retirement then bonds should compliment your portfolio depending on your needs.

Property. Ask anyone what they think about investing in property and you’ll get back 100 different answers. None of the responses matter as you should view property as any other investment in both risk versus reward. We’ve seen too many people, too eager to own a home and sometime it becomes a long walk into a lake of quicksand. Everything seems fine at first, then things start to struggle a bit and before you know it you’re up to your neck with no land in sight. If you need cash, you can’t just sell your kitchen. It takes time to sell a property so it’s all or nothing. However in most cases owning is more beneficial than renting, so make sure you’re within your means and purchasing for the right reasons.

Insurance. Yes there’s a thousand types of insurances but whether you’re buying car, home, health, tornado insurance, again the structure remains the same in that you buy insurance to protect something. Once you identify what that something is, then you’ll know what to look for. For example couples with young kids usually turn to life insurance as a means to protect their income in case something should happen, but be sure to cover both spouses even if only one spouse works. Covering the working spouse won’t compensate for the household duties of a caring for a family so the life changes this can force upon a family should be protected on all sides. In the ideal world you wouldn’t need to use any of your insurance so be sure the coverage levels aren’t too high as most insurances don’t offer a refund reward for making it through unscathed.

Once you’ve reached this point then you’re probably entitled to start looking at alternative investments. This can range from Fine Art to Tree Plantations and everything in between. Some companies only deal in alternative investments so their ideas can sound fantastic and look great on paper, but remember there’s a good reason why most investors should achieve all the areas above before even considering this less common area, and that comes down to risk. In many cases transparency and liquidity are the common issues but failed business models and unsustainable growth can also factor in. Therefore you should use Alternative Investments more to find non-market correlated assets rather than trying to find those quick rapid gains, so try to keep the lucrative ideas to a reasonable minimum and don’t bite off more than you can chew.

Already achieved all of the above, fantastic, then pat yourself on the back and start the cycle over again!

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Darren Cox

After being a financial planner since 2007, Darren is fully dedicated to providing expert advice and financial solutions to prospective and existing clients. Darren holds a Bachelor of Finance from University of Colorado. In his last position before joining Caterer Goodman he interpreted financial data and monitored economic, industrial and corporate developments in order to make the best investment decisions for his clients.

Tags: 1 Caterer Goodman Partners, Advice, Caterer Goodman, Caterer Goodman Partners, Caterer Goodman Partners, Caterergoodman, China Expat, China Expat Money, Darren, Darren Cox, Investment, Investment Cycle, Shanghai, www.caterergoodman.com

Categorised in: +CatererGoodmanPartners, Caterer Goodman Partners, Caterer-Goodman-Partners, Financial Advice, General, Investments

Comments are closed here.