Reforming like it’s 2005

Posted on October 15, 2012 I was reading the Economist over the weekend and an article from that fine newspaper caught my eye.

I was reading the Economist over the weekend and an article from that fine newspaper caught my eye.

It reminded me of a series of chats I had with a lovely retired stock market regulator I met in Shanghai in 2005. It’s an interesting story that I think there is a good chance that history is repeating itself with regard to the Chinese stock market.

Here is the story.

I struck up a conversation with Mike* who was nursing a beer at a table by himself at the wood paneled bar in the Radisson Xingguo Hotel where the Austcham drinks were held that year. It turns out that Mike had a fascinating 25+ year career in stock market regulation with the Australian Stock Exchange in Sydney. He was involved in many facets of regulation over the decades but the highest profile were his involvement in the prosecution of the two seminal insider trading cases in Australian regulatory history Simon Hannes and Rene Rivkin (co-incidently Rene Rivkin was born here in Shanghai)

The 2005 stock market review

Even more fascinating was why he was in China. He was leading a team of 8 highly trained regulation specialists producing a report into the Chinese stock market. This wasn’t for a hedge fund though. It was a non-public report for the Chinese government stock regulator the CSRC who was attempting to revive the Chinese stock market which had been moribound over the previous 5 years. The CSRC was trying to institute reforms to help the market.

Over the following months we met regularly every 2 weeks for dinner or a beer at Austcham Drinks and Mike would regale me with tales of shock, disgust and mirth on his discoveries of the details of the malformed Shanghai stock market. It was a long list. Stock brokers were all technically insolvent and on state government support and many had illegally lost client money. The market was starved of overseas capital and feared the SOE holding overhang of shares. Insider trading was rife. Regulotory oversight was a joke or helping insiders, and the list went on. As part of the research contract the team was to deliver a chapter including recommendations every two weeks on a particular sub-section.

PR as market support

After the first month it became apparent what the Chinese government was doing with the work from Mike’s team. Literally a week or two after his recommendation for that segment was submitted, a barely redrafted press release that summarized Mike’s recommendations was churned out through the state media platforms. Almost like clock-work. At the time we speculated that it was a good sign that the Chinese government was making these pronouncements to show its commitment to reform. We also wondered whether it was a ploy to increase investor interest in the Shanghai bourse.

A confidence boost

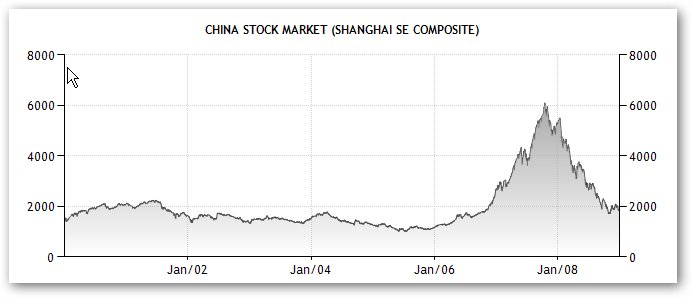

If it was, it certainly worked. In hind-sight the middle of 2005 was the nadir of the Chinese stock market. It ended the year on a positive note and 2006 was even better. The Shanghai market started the year at 1,209 and by year end was up a whopping 121%. The confidence allowed the market to cope with a pretty heavy load of new IPOs.

The boom went too far

2007 started to make 2006 look boring and the Chinese government got worried the inevitable fall would be too nasty and started announcing cooling policies like stamp duty increases and the like. It was well needed as the PE for the whole market got to 52 (15 is about average and 20 is considered high by most). I remember the deep lines of people outside banks each morning ready to trade shares. Eventually the government helped cool the market in the last few months with the market still finishing up only 99% on the year. The slide deepened into a rout in 2008 that foreign markets mimicked later the same year.

The market reforms were all enacted (I believe), but, as is often the case in China, enforcement was rather uneven to say the least. The main point however was the government, through its PR campaign of regulatory reform managed to help create the boom and stock market recovery after 5 years in the doldrums. That to us, sort of sounds like today, particularly when you read paragraphs such as the below from such a respected source.

During his first year in charge, Mr Guo has set about cracking down on insider trading, cajoling firms to pay dividends, opening the door to foreign investors, uprooting rotten companies from the exchange, and encouraging better firms to list on it, at better prices. In a year of political transition, when little was expected of China’s policymakers, he has been a “reform tornado”, according to China Economic Quarterly, a journal published by GK Dragonomics, a consultancy based in Beijing.

During his first year in charge, Mr Guo has set about cracking down on insider trading, cajoling firms to pay dividends, opening the door to foreign investors, uprooting rotten companies from the exchange, and encouraging better firms to list on it, at better prices. In a year of political transition, when little was expected of China’s policymakers, he has been a “reform tornado”, according to China Economic Quarterly, a journal published by GK Dragonomics, a consultancy based in Beijing.

The driving motivation behind this reform revival is a debate for another day. The fact that the government is clearly trying to revive the market however is clear and it seems, to me at least, very reminiscent of the last few months of 2005. Mike and his team eventually left Shanghai at the end of 2005 having produced a 1,400 page reform guide-book with more than 200 pages of recommendations. I wonder if Mr Guo has been busy thumbing through that old tome. Time to buy?

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, China, CSRC, Idea, Investment, Owen, Owen Caterer, Reform, Shanghai, stock market, View

Categorised in: Economic Commentary