Peak Yuan?

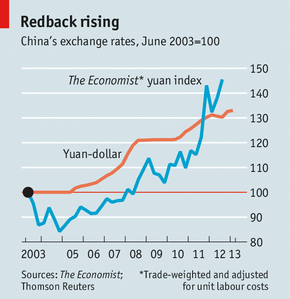

Posted on July 16, 2013 Way back in 2011 we predicted that the Chinese RMB wouldn’t get past 6 to a USD. That was a gutsy call at the time since the RMB was 6.48 and consistently appreciating at about 6% per annum from 6.8 not long before.

Way back in 2011 we predicted that the Chinese RMB wouldn’t get past 6 to a USD. That was a gutsy call at the time since the RMB was 6.48 and consistently appreciating at about 6% per annum from 6.8 not long before.

So are we going to eat our words now it is at 6.14? Not at all.

Actually we still argue that an exchange rate of 6 is about the top, so we argue that we are pretty close to peak rate for the RMB. Much of our statements made in 2011 in this report, still stand. Have a read here. But 2 years is a long time so some things have changed. Mostly to support our previous stance. What has changed?

Actually we still argue that an exchange rate of 6 is about the top, so we argue that we are pretty close to peak rate for the RMB. Much of our statements made in 2011 in this report, still stand. Have a read here. But 2 years is a long time so some things have changed. Mostly to support our previous stance. What has changed?

Well, the RMB has inched up as high as 6.1 to a USD. That’s pretty darn close, although it has sold off in recent weeks. In particular, note the quick-sell off in late June when fears of a banking crisis rose.

Note the spike in late June.

Competitive Problems

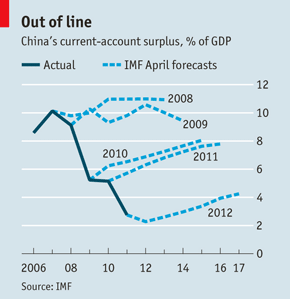

We keep seeing more reports that China is no longer cost competitive with other cheaper locations. The way to measure this is the trade surplus and in June, it shrank again by 14%. This leaves it far lower than it was before as this trend line shows. China is not nearly as competitive as it was. More evidence – have you heard any US senators complaining about the RMB being undervalued recently? That’s because it isn’t and this is reflected in the trade balance.

US Dollar Strength

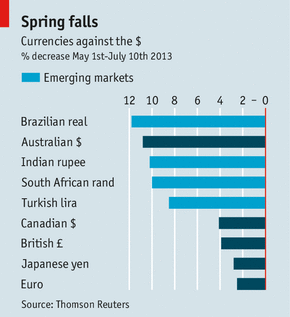

The US dollar in recent times has started to return to strength after being weak over the previous few years. Just recently it has risen very strongly. Being pegged (or even appreciating against) a strong currency isn’t exactly China’s idea of a good time.

Big Mac Index

The Big Mac index, just released by the Economist today (nice timing that) shows that the RMB is possibly still 40% undervalued, except for one small wrinkle. As the economist says:

The Chinese yuan is 43% undervalued on our basic gauge; adjusted for GDP per person, it is only 4% below fair value.

Why has the government allowed a rise?

Why the persistent myth of a stronger RMB?

We have two theories.

Recency Bias. The RMB has been going up, so it is likely to continue going up. It is the same reason the average investor piles into the stock market when it is up 20% and avoids it when it is down 20%. We are all trend followers at heart, although it isn’t always a wise investment strategy.

The second is I believe the average Joe (or Zhang) on the street mistakes a country’s rise for that of its currency. China is, indisputably, rising therefore the currency must also. They tend to ignore inflation rates, trade levels and competitiveness. These linkages are for economists, forecasters and boring nerds like myself. The boring nerdy links though are pretty clear.

The sole good argument for continued rises – Government Policy

There is a school of thought that says a stronger RMB is the government’s goal to helps find it’s natural level thus allowing a less volatile departure from RMB controls. Consider this argument from the Economist magazine this month. The economist notes,

“Li Keqiang, China’s prime minister, said that an operational plan for easing capital controls would be put forward later this year. If the yuan were much below its market value, relaxing capital controls could invite a destabilising influx of foreign money. By that logic, the government might have seen a stronger yuan as a necessary precondition for looser controls.”

This argument does mesh with the small but steady stream of relaxations around the RMB such as wider trading bands, more currencies offered direct settlement and public statements. It also supports the strong confidence that we and many finance industry contacts have noticed with Shanghai financial officials, who in private conversations also say opening of the RMB is a matter of time.

If relaxation will continue, will the RMB continue to rise? It will keep rising if it hasn’t found its natural level. Of course, if it has found it is true level, we might be looking at a currency near its peak given higher cost inflation in China.

So, it is time to celebrate peak Yuan? What do you think?

Want to learn more?Join our private LinkedIn Group that shares the inside story.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, China, China Expat Money, Chinese Yuan, Expat, Investment, Money, Owen, Owen Caterer, Peak, Renminbi, Rise

Categorised in: Investing in China, Investments