Lazy money, hard working boss

Posted on December 16, 2013 It’s now mid-December and if you are like most people, you are on the mad sprint to get everything finished before your Christmas vacation. You have worked hard this year, but has your money worked equally hard. Are you keeping your money in the bank by accident with the intention of “I’ll get round to doing something with that shortly…”?

It’s now mid-December and if you are like most people, you are on the mad sprint to get everything finished before your Christmas vacation. You have worked hard this year, but has your money worked equally hard. Are you keeping your money in the bank by accident with the intention of “I’ll get round to doing something with that shortly…”?

Quite possibly 75% of the people I meet have had a significant sum of money in their bank accounts for years. One had been there for 5 years, doing exactly nothing.

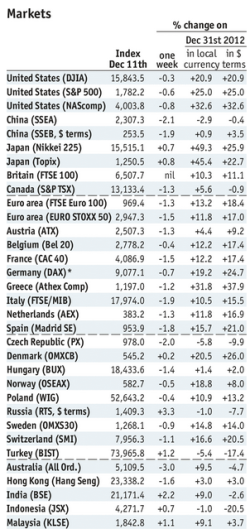

Well, here are the returns that you missed this year. Many markets had a very good year as this table from the Economist magazine shows. For a full table link here.

Did you see the US with 25% for the S&P 500? Japan with 25% also? Even the EU is in the high teens (18%) and there are a dozen others with double digit plus growth

Yes – but haven’t I missed the boat?

Yes equities have had a good run, but the emerging markets poor run means they are now good relative value. Some REITs offer great yields and good potential upside. Some individual equities have missed the boat. The list goes on. There will be some excellent returns in 2014 in some categories, that’s for sure.

What did you do about it?

Now the question is. Are you going to let 2014 pass you by also? Or will you prioritize and make some plans to either get investing or start working with an adviser who can help you? You might be busy, but that is all the more reason to get your money working hard too. With interest rates still at record lows, putting money in the bank is just a waste of time.

Don’t be an enabler of lazy money. Put a note in your calendar for January to “do something about that cash we have” and then make it happen. Don’t let another year slip by.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, China Expat, China Expat Money, Financial Advisor, Investment, Owen Caterer, Shanghai

Categorised in: General, Investments