How to get wealthy: book a date with your finances

Posted on March 3, 2017It is around this time of year people begin booking their summer holiday. Rest and refreshment is important so people block their schedule. They prioritize it. Those who have successful marriages do the same by making sure they have a date night weekly. Home finances including your plan, budget and even routine work are probably just as important, but do you treat it with the same respect? Do you plan a time to work on your financial plan? You probably don’t, but you should.

Doesn’t it make sense to treat your money, the fruits of your efforts of 2500+ hours a year, with incredible respect? The effects are amazing, but practically no-one actually does even the bare minimum.

In our experience perhaps only 5-10% of people are truly organized.

Here is what we see the organized do:

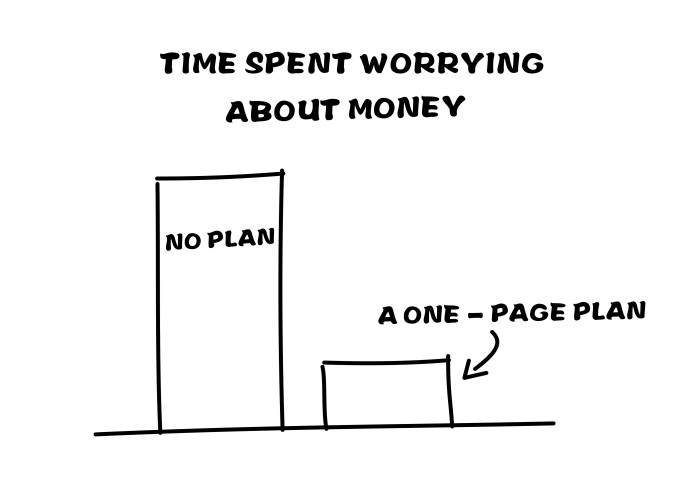

- They have a one page plan listing their goals for short term (1-2 years), medium (2-5) and long term (5 years+). This includes a basic action plan.

- They have a spreadsheet that lists current investments and accounts which they update quarterly to track performance.

- They block time in their schedule to do financial paperwork as required.

- Have a basic budget they review every 6 months or so.

- They have all their key financial documents in a specific organized file such as passwords, policy documents, wills, statements.

None of that sounds hard, does it? Yet so few do, perhaps because they see it as a chore.

We are all busy – it’s a question of priorities.

Practically every client or prospect I’ve ever met who isn’t organized has said they are too busy to get organized. These include people who should know better including investment bankers, partners in Big 4 consultancy firms all the way to entrepreneurs, engineers and teachers. The most organized however are also these same types of people. What they do different is they simply block their schedule. They treat it like any other work activity: plan it, schedule it, get it done.

Get organized; get wealthy

Practically every single one of my clients who has shown signs of being organized as mentioned above is also in the top 5% of wealthiest clients. It’s not a coincidence. You don’t accidentally accumulate wealth and retain it. You spend time and work at it. A small amount regularly still adds up to less than 25% of the time you are likely to spend eating out with friends during a given month. Almost every client I have with more than $2 million in net assets could tick off 3 of the 5 (or more) from the list above. Can you?

Being busy is an excuse

What is interesting to me is how the most organized people also tend to be the most successful in their career. They are often country and regional CEO’s and are people who have a million responsibilities and good reasons not to be organized in their finances, yet they are. That’s down to a simple thing – they book a time to get organized. That’s their habit for everything. They schedule their time to plan and do paperwork and simply get it done. They use the same principles with their career, probably their family as they do with their finances, and the long-term effects are amazing.

Not having money is an excuse

People often say I don’t have money so I don’t need to be organized or have a plan, but in our opinion that’s all the more reason to get organized. Clearly there is a problem! Ignoring it might make you feel better temporarily but ultimately awful in the long term. Every month I meet a 40+ person with minimal assets who still can’t face the issue. Don’t let this be you. The longer it goes, the deeper the rut you need to climb out of. Start with a budget and a few dot points for goals including an amount to save each month and how much you will accumulate by the end of the year. Start small and step by step you will get somewhere amazing. As Mao said, “a journey of a thousand miles starts with a single step”. The investment equivalent would be “a million dollar account starts with a single cent”.

Book a date night with your finances.

So, when you are discussing your summer holidays with your significant other over the next few weeks, also book a time during your holiday to talk family finances. It might just be an two hours during an afternoon, but see how many of the big 5 you can tick off including a regular schedule of maintenance say one Sunday night a month. An on-going date night with your finances if you will. It won’t be much time really, but it will ultimately be very rewarding.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients' interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and havenow been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: @caterergoodman, Caterer Goodman, Caterer Goodman Partners, China, China Expat, China Expat Money, Comparison, Expat, Fee-based, Financial Advisor, Financial Planning, Financial Review, Investment, Money, Owen, Owen Caterer, primarily fee-based, Shanghai, Shanghai Expat, Wealth Management, www.caterergoodman.com

Categorised in: +CatererGoodmanPartners, Caterer Goodman Partners, Caterer-Goodman-Partners, Financial Advice, General, Investments