Education Savings Plan

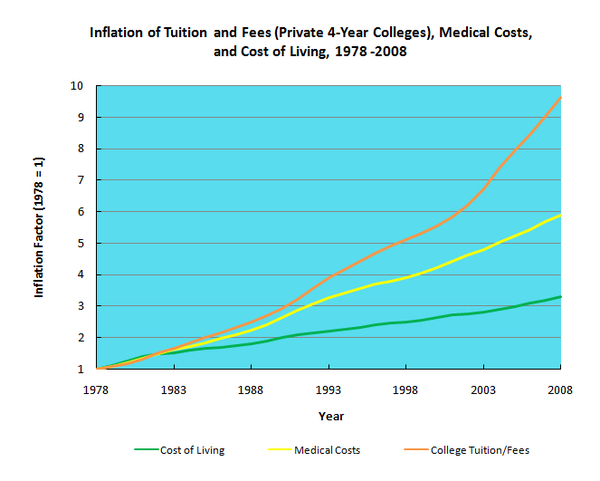

Posted on November 19, 2016Are you ready for the school fees? I don’t just mean for 2016. I mean for university. Education inflation has been, for the last several decades at least, 4 times higher than normal inflation. Education at a top quality university, can already set you back $40, 000-75,000 USD per year at today’s prices. What will be there price in 10 years when your child is ready?

What to look for?

- Low Cost

- When shopping

- Access to your money

- Tax advantaged*

- Good low cost fund range

- Simple

One final thing: It doesn’t need to have “education savings plan” on the wrapper. It is the solution that counts, not the marketing.

Why does access to my money matter?

Let’s ask the reverse question. Why should lock your money up, be a benefit to you? It’s not benefit. It’s a restriction, and should be treated like a cost. Despite the illusion of control we all have, we never really know what the future will hold, so locking your money away so you can’t touch it without a costly penalty is not in your best interest.

Should I use an Insurance companies “Savings Plan”?

Not these days. Perhaps as late as 5 years ago, unit linked insurance “savings plans” were a competitive offering. These included investments like those from Generali International’s Vision and Aviva International’s Global Savings Account (GSA). With exchange traded funds becoming mainstream over the last 7-8 years, however, they are no longer competitive. Like Nokia or Blackberry, technology has improved, but they haven’t. Exchange traded funds (known as ETFs) are a much lower cost solution than mutual funds.

Online Brokers: ETFs changed the game

With the advent of exchange traded funds to the mainstream about 7 years ago, a humble stock brooking account from an online discount broker is the cheapest and most flexible solution available. Now you won’t find many advisers working with these solutions, since there are no large hidden commissions. It is a fee-based business that keeps the adviser focused on delivering good returns for the client. Most advisers’ key competency is sales, not management, so you can see how this new paradigm makes them uncomfortable. They need to evolve.

So in summary, what sort of Education Savings Plan should I get?

Either manage your own account, or work with a managed account provider like us who offers the following:

- Online discount brokerage account

- 100% access

- Low cost annual management fee

- Access to the world’s exchanged traded funds

There are several online discount brokers around. See Barron’s for a list.

If you keep those four simple things in mind, then you can start saving and investing for your children’s future, safe in the knowledge that you have the world’s best investment approach. Ignore the marketing of “education savings plans” and keep the end goal in mind. Growing the pot of money available for your kid. That way, you can ensure the only person getting an expensive lesson is your kid and not you.

*Except for Americans who pay tax no matter their country of residence. Americans can consider 529 savings plans, although keep firmly in mind the large penalties that can apply if you don’t use this money on education expenses.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients’ interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and have now been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: 1 Caterer Goodman Partners, Caterer Goodman, Caterer Goodman Partners, Caterer Goodman Partners, Caterergoodman, China Expat Money, Complaints and Reviews, Education plan, ETF, Investment, Shanghai, www.caterergoodman.com

Categorised in: +CatererGoodmanPartners, Caterer Goodman Partners, Caterer-Goodman-Partners, ETF's, General, Investments