How to hide fees and plunder people

Posted on May 11, 2015Since some people lack a sense of humor or an ear for irony, let’s be 100% clear. The following is a parody article. I’ve written it to help average investors protect themselves from expensive investment products. The vast majority of investments that underperform do so due to fees, both hidden and apparent. We’ve been teaching our friends and clients what to look for when analyzing investment products for years so they can protect themselves. So, now, imagine a broker dressed like Gordon Gecko and be prepared to accidentally learn some useful tips on investing.

>>

So, you want to build an investment product business? To build a successful investment offering you need to keep in mind that charging higher fees is going to help with every step. It will help you succeed and of course help your profitability. You would think that a better performing product would attract the most clients. Not true. Let’s remember that most people don’t know how to benchmark a fund’s performance using Google or Yahoo finance. Perhaps they are either too busy or lazy, I’m not sure. For most average investors, it just doesn’t happen. They key is marketing material and your sales channel, since that’s how most people buy.

So, you want to build an investment product business? To build a successful investment offering you need to keep in mind that charging higher fees is going to help with every step. It will help you succeed and of course help your profitability. You would think that a better performing product would attract the most clients. Not true. Let’s remember that most people don’t know how to benchmark a fund’s performance using Google or Yahoo finance. Perhaps they are either too busy or lazy, I’m not sure. For most average investors, it just doesn’t happen. They key is marketing material and your sales channel, since that’s how most people buy.

Key 1: Keep the sales channel happy

It will help you to offer attractive commissions to the salesmen selling your product, amusingly calling themselves independent financial advisers. You’ll need to pay a combination of an upfront commission and a trail, which is part of the management fee from the fund manager. Don’t worry, we aren’t cheating ourselves, that’s all budgeted in. Whether the upfront commission is big enough depends on the jurisdiction and what your competition is getting away with offering. It might be as small as 5% but for some “fund platforms” it can be up to 10%.

Having a happy sales channel will ensure that plenty of people are selling your wares. This outside group is a key to success. Also having a separate sales channel can help protect you against any charges of miss-selling since you will provide all the details on charging in an investment memorandum the size of Tolstoy’s War and Peace, just more turgid, in the interests of transparency of course. The broker will of course forget to offer this or, if he does remember, he’ll fail to highlight the key details on page 59. That’s not your fault, of course. Plausible deniability.

Yes, retail investors are a pain since they means dealing with lots of clients rather than a couple. But remember, institutional investors will ask tricky questions and want to understand everything since they are distrusting and know how the game is played. They will demand no bid-offer spreads, better terms, clarity on your investment strategy and regular updates on what assets you hold, lower management fees and will benchmark your performance against your peers and an index. And, if you don’t deliver, they will leave. That’s just too much pressure for your business and lower margin work.

Key 2: How your fund can pay for the channel

If you are selling a fund directly it is pretty straight-forward. You won’t have any entry or exit costs, at least legally speaking and it is important you say “no entry costs” on your fund. You see bid-offer spreads are two different prices. A higher buy price and a lower sell price. These aren’t fees (at least legally speaking) so you aren’t lying when you say no entry costs. Few people will notice and those that know to ask “are there any bid-offer spreads” will probably already be buying their own no-load ETFs via a discount broker. For those that don’t, they will never notice that when they withdraw money at a later time that it is a few percent short of where it should be and just blame the markets in the last few weeks or months of their investment period. Easy.

Trails come from management fees and it is pretty easy to convince average investors that a 1.5% is reasonable compared to a 2% fee and 20% of profits that some hedge funds charge. The key is to anchor the client by mentioning high charging alternatives first so yours seem reasonable by comparison.

Yes, there are exchange traded funds called ETFs that can track the market for as little as 0.07% but most average investors still haven’t heard of these things. Brokers won’t want to educate them either. Many clients naively think that anything with an acronym must be a weird risky derivative. As a broker you can help feed this bias by calling ETFs “new and unproven” to subtly cast doubt on a method used by all professional investors.

Key 3: How to run your investment platform

If you truly want to generate a profitable business, a fund platform is really where it’s at in terms of opportunity. With so much scope for complexity and layers, you have so many more places to hide the fees you will plunder from your clients reasonably need to charge your investors.

Use lock-ins “for their benefit”.

First, you will have a lock-in or investment period, perhaps over 5-8 years but possibly up to 30 years for smaller regular investments. This is not for the benefit of your investors, although you and your introducing brokers will say that it is. You’ll say that it is to keep them on track and on they saving plan and protect them from themselves. Brokers will explain, verbally, that after a year or two then the investment becomes “completely flexible”. The client will think they can withdraw all their money. What the broker means is that they are simply allowed to stop contributing. This won’t be clarified until 3-5 years later when the client tries to close their account. Of course by preventing access to said money you are still protecting the client.

The real reason is that it gives you more time in control of their money while you can charge your investors subtly and slowly behind the scenes, and continue to control it long after they have realized it was a dud. To help with this you will have lots of suggestions that this is for long-term saving for retirement or children’s education. A elderly couple sailing a yacht or walking along the beach should do nicely. A complex investment structure with some bonuses to cloud calculations and inspire clients to “make their decision this quarter before the special offer goes away” also helps.

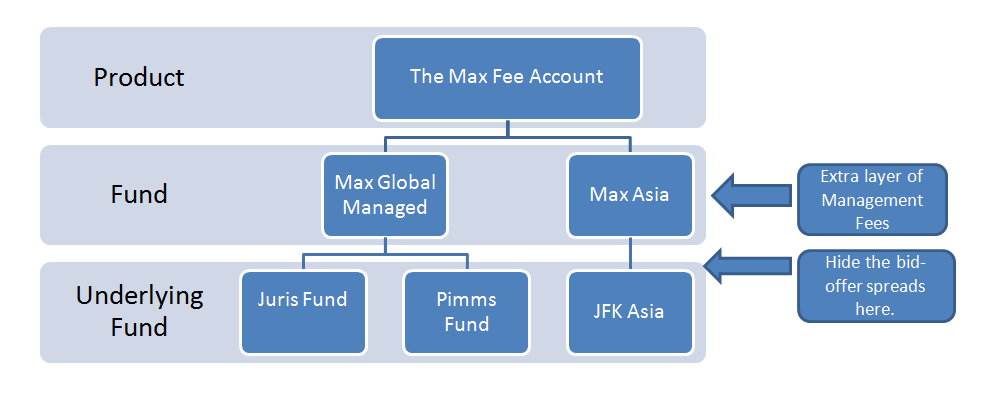

Build an extra layer – that’s where the gold is

Now, many funds sold to average investors have bid-offer spreads and some clients are on to this, so you will promise to ensure that there are no switching costs including no bid-offer spreads on the funds they use. Don’t worry, you aren’t turning into Mother Teresa, there is a method to your madness. Your solution is to bury those bid offer spreads down a layer. You’ll create an extra layer of funds that you will manage by investing into underlying funds, who will do the real management work. This little trick is sometimes called “mirror funds”. Brokers will claim these mimic the best fund managers, but in reality it is just an extra layer. These little beauties have two wonderful little revenue lines that can have you owning that nice spread in the south of Spain long before you turn 40.

Mirror Fund Management fees are actually fund management fees, so when the broker discusses your product, he won’t include them in the list of product fees. So your product will look cheaper than it really is. Still, these fees will end up in your pocket for no real work AND you’ll tell your clients you are providing them with free fund switches. Solid rivers of gold.

Even better is a little trick of collecting commissions when your mirror fund invests into the underlying fund. Wait… what? Now remember when I told you that funds have a bid offer spread for retail investors? As I explained that usually goes to the introducing broker, but he can waive that and get his clients in cheaper at the institutional rate. As the product owner we won’t do that, and since we are the introducing broker, we can collect the commissions. Uncovering this little trick is beyond even the most determined and savvy retail investor since you can reasonably claim that the funds prices include all “administration, valuation and buying costs associated with their assets”. Which they do.

Don’t worry about lawsuits claiming you didn’t disclose anything. You will disclose and that will protect you from frivolous lawsuits and nosy regulators. Prying eyes won’t be able to make head or tail of the long complicated and seemingly innocuous pages of explanation as to how the funds value their assets, and how purchasing costs are included in your funds returns. Say hello to another 1-5% each time money enters an underlying fund. This can happen even if clients are just switching en masse from your Asia Fund to your Europe Fund. Don’t go overboard and charge 5% entry on underlying deposit funds. People will get suspicious. Keep those spreads for equities and emerging market funds and just blame the markets, timing or the fund manager if anyone thinks the funds aren’t doing so well. Talk about money for jam.

Furthermore, if things get a little slow after a few years and your clients aren’t adding money like they used to, you can help them do an unrequested fund switch. The idea is to swap the underlying fund manager for your Asia fund, say for poor performance. Say you have a Global Equity Fund which uses AAA fund managers. You simply fire them and move money in your mirror fund to the new Better Beta Fund Managers and win another 5%. Who says risk free returns don’t exist? Even better, the fund performance lag won’t start to show up for years until the fund starts shrinking, and by then you’ll be well on your way to wife number 3. The client also will have long since forgotten about the shoddy investment they made during their time in Asia.

But won’t people figure it out?

Well the sophisticated finances types have, and sometimes they even write articles and blog posts on these topics. Fear not, most people won’t spend the time to read these articles or understand them correctly. Don’t worry about brokers: they are on your side. They want deals that pay them well after all, so they aren’t looking for holes. They are looking for angles. Besides, you won’t take the time to train or explain how the product truly really works. An adviser who doesn’t understand the truth, finds it far easier to lie and say something is cheap. He actually believes it is the truth, and that makes it far more powerful. That way, even the handful of diligent advisers will faithfully sell your investment and look people in the eye and explain that the product charges are all there is to the investment. That this investment will make you money and the fund charges are “the same for everyone”.

Don’t worry about fund tracking companies like Morningstar. They compare funds mostly for institutions and don’t dirty themselves trawling through offshore retail products. Offshore regulators only check to make sure that your legalese roughly matches reality and that you aren’t taking money from Columbian drug lords. There is no test about whether the product is fair or likely to make money. Yes, Hong Kong is waking up and the UK, the US and Australia don’t make it easy. But for the most part regulators aren’t there to provide competitive pressure. Speaking of competitors, they aren’t a concern either. Their main worry is whether you are offering the sales channel bigger incentives than they are, and convincing the brokers to sell your product instead of theirs.

But what about the inter-webs and comparison sites? True product comparison websites will be still-born in the face of our lawsuits and threats on disclosing confidential data. The internet is 20 years old and we’ve succeeded every time so far, haven’t we? Besides, where is the revenue for the comparison site? Who is going to advertise on a site telling everyone how rotten the industry products are and that they could do it themselves with a handful of ETFs and their own discount brokerage account or hire a portfolio manager for a small fee to do it for them?

Clients prefer free advice which is how we lure them into our expensive kick-back based products. Do you think they’ll ever understand the irony?

—-

Again, this was a parody article. So in summary, here are the learning points.

- Use Exchange Traded Funds – they are cheaper and better

- Beware of commission based financial advisers.

- Don’t lock your money in.

- Avoid layers of fees from mirror funds.

- Manage conflict of interest by paying your adviser to manage a collection of ETFs for a management fee that is cancelable at any time.

- Free advice is like a free lunch: there is no such thing.

About Caterer Goodman Partners

Caterer Goodman Partners is a Shanghai based wealth management firm established with a clear vision to provide a new level of personalized financial planning services for expatriates in Asia. Our financial advisors provide guidance for our clients in all areas of investment, specialising in managed accounts, money-market funds, retirement planning and alternative investments. At Caterer Goodman Partners, we offer our advice and experience to provide low cost, tax-effective and simple solutions to match our clients' interests.

About Owen Caterer

Since graduation Mr Owen Caterer has worked with the Queensland Premier's Department in Trade Facilitation and then as a financial adviser in Shanghai from 2005 until 2010. He then rose to Senior Adviser, then Business Development manager and then to Chief Investment Officer responsible for portfolios to a value of US$280 million across Asia. Following that Mr Caterer left to found his own firm with a partner in the financial advisory and wealth management area. This focused on developing China and Asia's first fee-based financial advisory (rather than commission-based). This has grown to now have 8 staff and and managing almost US$35 million for clients throughout Asia. This business success was recognized as a finalist in the 2013 ACBA in the Start Up Enterprises category and are one of a small number of foreign managed firms to have a full asset management license in China. Owen has also been active in the community volunteering for the Australian Chamber of Commerce in Shanghai and acting as the Vice-Chair of the Small Business Working Group (2012-2014) and as the Co-Deputy Chair of the Financial Services since 2013 until the present. They have continued to grow their business and havenow been selected as a small group of companies who are platinum members of the Australian chamber of commerce. The achievement they are most proud of is their efforts to reform the financial planning industry in China and push it away from a hard-sales commission driven model to a more ethical management fee and long term customer service model. Owen has a Graduate Diploma of Applied Finance from the Securities Institute of Australia of which he was a member as a Fellow of Finance for many years and also has an undergraduate degree from Griffith University in International Business. Owen's interests are tennis, running and his wife and two children. He speaks fluent Chinese, first arriving in China in 1997.

Tags: Caterer Goodman, Charges, China Expat Money, Hidden Fees, Investing tips, Investment, Owen, Owen Caterer, Products fee, Tips

Categorised in: Financial Advice, General, Investments

Comments are closed here.